Read the latest news from campus: How campus units are collaborating to provide PPE for medical staff • UCLA researchers and global effort to test therapies • A summary of the "CARES Act" Congress signed into law and Gift Planning news. read more

UCLA charitable gift annuities-Higher rates effective January 1, 2024! For more information, contact [email protected] or 800-737-8252

Ways to Give

Support UCLA through your Estate

A flexible way to build a meaningful legacy and strengthen the university and its mission. read more

Give and Receive Income and Tax Advantages

A life income gift allows you to give assets to UCLA while providing yourself or others with income for life or a set period of time. read more

Give and Receive Tax Benefits

Some types of planned gifts provide you with significant tax advantages. read more

Assets to Give

You can fund your legacy gift with many types of assets: appreciated securities, real estate, retirement plans, and other possibilities. read more

Donor Stories

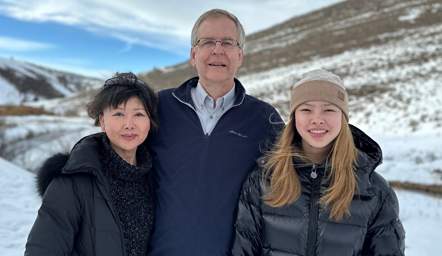

A Life-Changing Gift

Read about why and how Ed Griganavicius decided to support UCLA with a bequest. read more

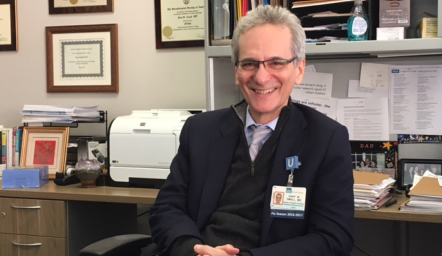

Composing a Legacy

Read about why and how Professor Mark Carlson decided to support UCLA with a bequest. read more

A Legacy for Loved Ones

Read about why and how Bronwyn Bateman decided to support UCLA with a bequest. read more

UCLA News

Clark Library

William Andrews Clark Memorial Library has undergone an extensive seismic retrofit and brought into compliance with the ADA. read more

Memory and Mood

A study conducted by UCLA researchers shows curcumin improved memory and mood. read more

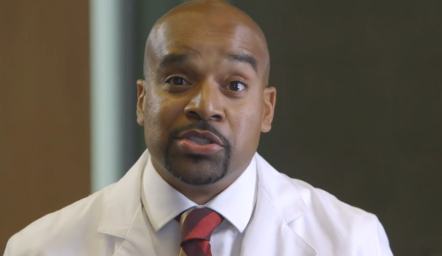

Black Men in White Coats

UCLA joins campaign to inspire underrepresented minority students to become physicians. read more